If you’re a business owner considering selling, it’s crucial to approach the process with a clear, realistic mindset. One of the biggest challenges owners face is emotionally detaching from their businesses. When you’re deeply invested in something, it’s easy to overestimate its value. However, to secure the best deal, you need to view your business through the eyes of a potential buyer.

Here are 3 key points to keep in mind to avoid overvaluing your business:

Set Emotions Aside

Your business likely holds a special place in your heart. You’ve invested time, energy, and resources into it, which makes it feel invaluable. While emotions are natural and a testament to your dedication, they can cloud your judgment when determining the true market value of your business.

The fact that you sold your car or home to fund the business, worked during weekends, or missed a family event to meet a client is not going to be important to a buyer when valuing your business. That’s why, when selling, it’s vital to put emotions aside.

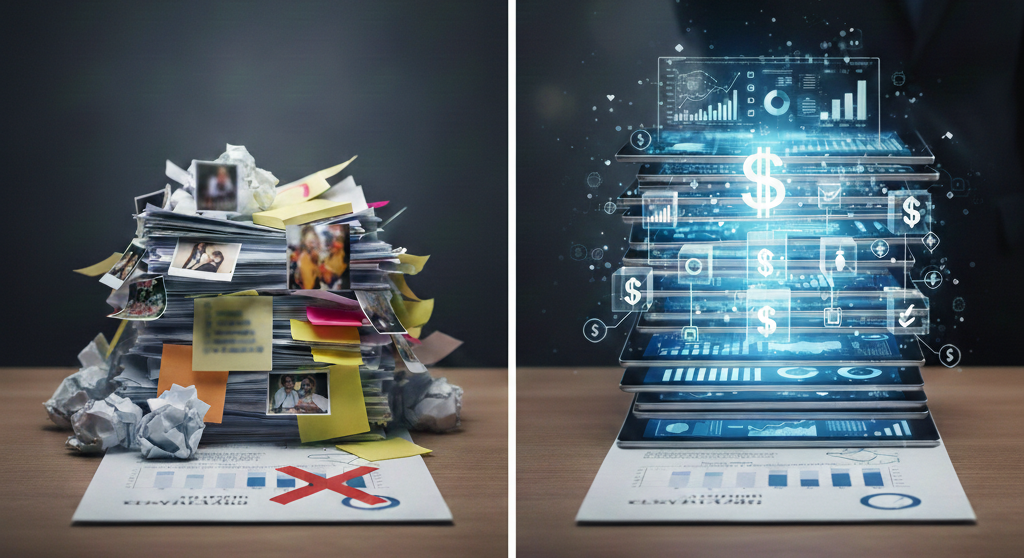

Instead, the buyers will be looking at the facts. What you see as a labor of love, they see as an investment. It’s important to be objective and ensure you’re assessing your company’s value based on facts, not feelings.

Buyers Focus on Outcomes, Not Your Journey

While you may have spent years developing your product, refining ideas, and working through countless trial-and-error stages, a buyer will focus on the final outcome, not the journey. The time, money, and effort you invested to get the business where it is today—along with the failures along the way—won’t add value in their eyes. What matters most to a buyer is the current state of the business: its profitability, stability, and future potential.

As a seller, be ready to back up your asking price with solid data. Highlight your business’s financial health, opportunities for expansion, and competitive position in the market. Remember, no matter how hard the path has been, the buyer will only be interested in the destination—the finished product and its potential for growth.

Avoid Overconfidence

Overconfidence can be a hidden trap when selling a business. Many business owners overestimate the market value of their company, assuming their personal investment makes the business more valuable. This overconfidence can not only prolong the selling process but also lead to missed opportunities for a fair deal.

It’s essential to be realistic. Seek external perspectives, such as financial consultants, to help you determine a fair valuation. Also, study the market, understand what similar businesses are selling for, and adjust your expectations accordingly.

How Advisory34 Can Help

Selling your business is an emotional and complex process. By keeping emotions in check, focusing on outcomes, and avoiding overconfidence, you’ll be better positioned to strike a deal that reflects your business’s true worth.

Advisory34 provides expert guidance to help you objectively evaluate your business and market position, ensuring a fair and balanced approach to the sale. Our team specializes in helping business owners maximize value, streamline the selling process, and secure the best possible outcome for your hard work.