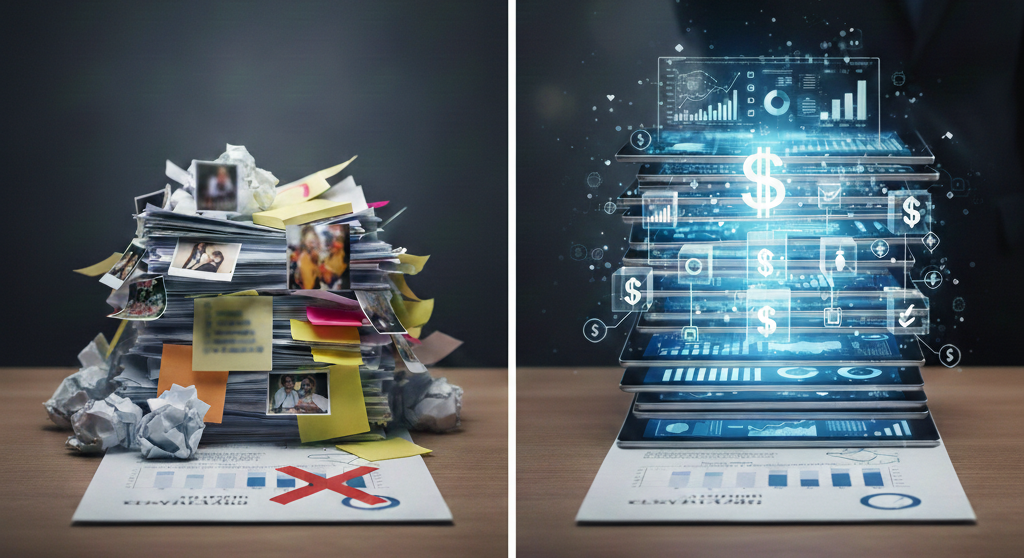

When most business owners think about their company’s assets, they list what they can see: real estate, stock, machinery, vehicles, and cash in the bank. These are the hard assets, the tangible pieces that appear neatly on a balance sheet. But for many businesses, the true value lies elsewhere.

The real question isn’t what you own, but what makes your business valuable to someone else.

At Advisory34, we regularly support entrepreneurs, founders, and SMEs who are considering growth through investment, sale, or strategic partnerships. One of the most common surprises in this journey? Discovering that their most valuable business assets aren’t physical at all.

The Invisible Assets That Drive Real Value

Here are some of the overlooked (but often decisive) components that shape your company’s valuation in the context of M&A:

1. Customer Relationships and Loyalty

Do your clients stick with you for years? Do you have long-term contracts, subscriptions, or a reputation for strong client service? These can translate into recurring revenue and lower acquisition risk—both of which boost value. A high customer lifetime value (CLV) is a hidden gem.

2. Brand & Reputation

Even without mass-market recognition, your brand equity—especially in a niche or local market—has weight. Online reviews, word of mouth, and trust in your name can influence a buyer’s perception more than assets listed on a spreadsheet.

3. Product Innovation & Technology

Does your business offer something no one else can easily replicate? A unique product, a proprietary formula, patented technology, or a protected service model can significantly increase your valuation. These kinds of innovations—especially when supported by intellectual property (IP), trade secrets, or exclusive supplier relationships—act as powerful barriers to entry for competitors.

Whether it’s a custom-built software, a unique aesthetic procedure, a patented device, or a specialized service framework, these innovations give buyers confidence in your ability to maintain margins, defend market share, and scale.

In many cases, this is where the real value lies—not just in what you sell, but in how hard it is for someone else to copy it.

4. Processes & Know-How

How you operate is often as valuable as what you offer. Proprietary methods, unique workflows, and deep operational knowledge can be powerful differentiators. If your team has developed internal expertise or industry-specific know-how, that’s a form of intellectual capital that adds depth and resilience to your business.

5. People & Culture

The strength and cohesion of your team, your internal leadership, and your company culture are all value drivers. A company with low turnover, high employee engagement, and leadership potential offers stability to any buyer or investor.

6. Data & Insights

Many businesses collect data—on customers, on operations, on performance—but few leverage it. If your data can be turned into insights or operational improvements, it becomes a strategic asset. Buyers love businesses that know what works, what doesn’t, and how to improve.

7. Digital Presence & Community

Your website, SEO performance, email list, or engaged social following may seem like marketing details—but to the right buyer, they’re growth engines. These are assets that reduce customer acquisition costs and support brand expansion.

Why This Matters in M&A

M&A isn’t just about financials—it’s about future potential. What is the buyer really buying? Stability, scalability, and opportunity.

That’s why two companies with the same revenue can be valued very differently. One may rely heavily on the owner’s involvement, have no systems in place, and little brand awareness. The other may be automated, have a strong team, a loyal client base, and scalable processes.

In short: the more “invisible” value you can identify and present, the more leverage you have.

How Advisory34 Helps Reveal Your True Worth

At Advisory34, we go far beyond the typical M&A checklist. We specialize in:

- Diagnosing the real value drivers in your business—beyond the numbers.

- Uncovering hidden, strategic assets that matter to acquirers and investors.

- Positioning your business to command a premium, using a combination of strategic narrative, financial analysis, and M&A experience.

- Supporting negotiations and deal structuring to ensure that value is not only shown—but captured.

Whether you’re looking to sell in the short term or just want to understand your options, we provide clarity and strategy. If you’re wondering what your business is really worth, or if you’re sitting on untapped value, let’s talk. The invisible part of your business might just be your biggest asset.

Reach out to our team to learn more or schedule a strategic discovery call.