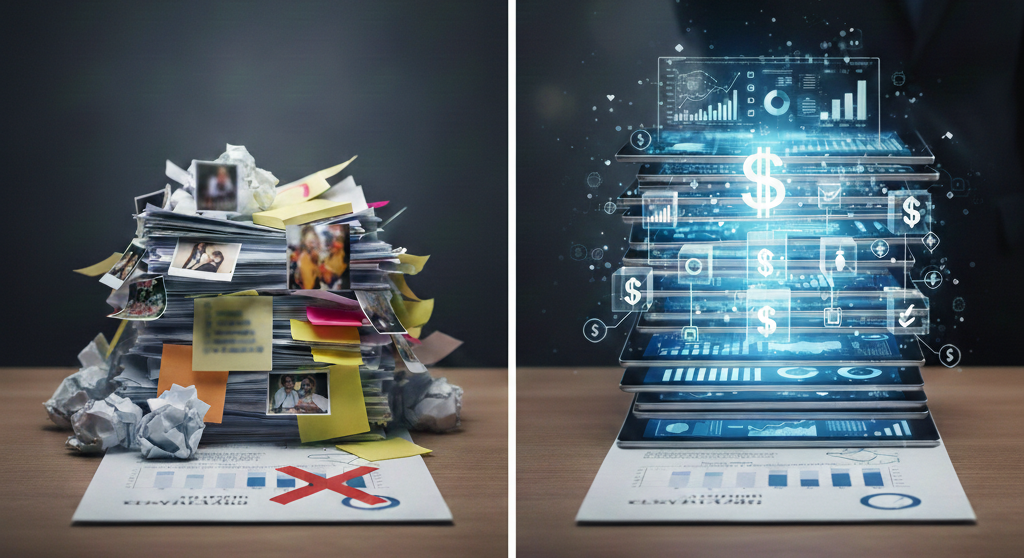

As a business leader, one of the most critical decisions you’ll face is how to grow your company. Two primary methods stand out: organic growth and growth through acquisition. While both strategies can drive expansion, they each come with distinct advantages and challenges. The best approach often depends on your company’s goals, resources, and market conditions.

In this article, we’ll break down the pros and cons of each strategy to help you determine which one is right for your business.

Organic Growth: Steady and Sustainable

Organic growth refers to expanding your business by increasing output, improving sales, or developing new products using internal resources. This is the most traditional form of growth and relies heavily on building on your existing capabilities.

Pros:

- Control and Risk Management: Organic growth allows you to maintain full control over your operations, resources, and business direction. You can expand at a pace that aligns with your financial capacity and business model.

- Sustainable Development: Since growth happens gradually, it’s often more sustainable. You grow based on your company’s ability to generate revenue, without needing significant external financing.

- Strong Brand Identity: Building your business organically strengthens your brand identity and customer loyalty. It demonstrates stability and long-term commitment to your market and clients.

- Lower Initial Costs: Organic growth doesn’t require the upfront capital investment often needed for acquisitions. Expansion comes from internal profits and resources rather than large outlays of cash or credit.

Cons:

- Slower Growth: Organic growth tends to be slower. It can take years to achieve substantial market share, and competitors may outpace you by expanding faster through acquisitions.

- Resource Strain: Expanding internally puts pressure on your current resources, whether it’s manpower, time, or finances. Growing too fast can overextend your resources, leading to operational inefficiencies.

- Limited Reach: Without acquisitions, your company might miss out on lucrative opportunities for market expansion, especially in new regions or industries.

Growth Through Acquisition: Speed and Scale

Acquisition-based growth involves buying another company to expand your operations. This strategy can rapidly scale your business and provide instant access to new markets, customers, or technologies.

Pros:

- Rapid Expansion: Acquisitions allow you to grow much faster than organic methods. By purchasing an established business, you gain immediate access to their market share, customer base, and assets.

- Diversification: Acquiring another company can help you diversify your product offerings, services, or geographic presence. This reduces dependence on a single market or product and lowers business risk.

- Synergies: Acquisitions often create synergies that can reduce costs and improve efficiency. By merging operations, you can eliminate redundancies, combine expertise, and leverage shared resources.

- Instant Competitive Edge: Acquiring a competitor or a company with complementary strengths can give you a significant advantage in your market by reducing competition or bolstering your capabilities.

Cons:

- High Initial Costs: Acquisitions require significant upfront capital, and the purchase price can be hefty. Financing an acquisition through debt can also increase financial risk.

- Integration Challenges: Post-acquisition integration is a major hurdle. Differences in company cultures, operational systems, and management styles can lead to conflicts, making it difficult to fully realize the benefits of the acquisition.

- Risk of Overpayment: There’s always a risk of overpaying for the acquired business. In some cases, the expected synergies may not materialize, leaving the buyer with a financially draining asset.

Which Strategy Is Right for You?

When Should You Consider Organic Growth?

- Have a strong existing customer base and want to increase their share of the market gradually.

- Are focused on long-term sustainability and want to avoid the risks associated with high levels of debt.

- Prefer to grow by building on their internal strengths rather than merging with other organizations.

- Operate in industries where innovation, brand loyalty, or operational efficiency can drive growth without the need for acquisition.

When Should You Consider Acquisitions?

- You need rapid expansion to outpace competitors or seize a time-sensitive market opportunity.

- You want to diversify your offerings or enter new geographic markets quickly.

- The industry is highly competitive, and purchasing competitors can give you a decisive edge.

- The company you’re acquiring has assets or expertise that can significantly enhance your operations or technology.

At Advisory34, we help businesses navigate the complexities of growth—whether through acquisitions or organic expansion. Our expertise in M&A strategy, business valuation, and deal structuring ensures that you make the most informed decision for your business. Reach out to us for a consultation on how we can guide you through your growth journey.