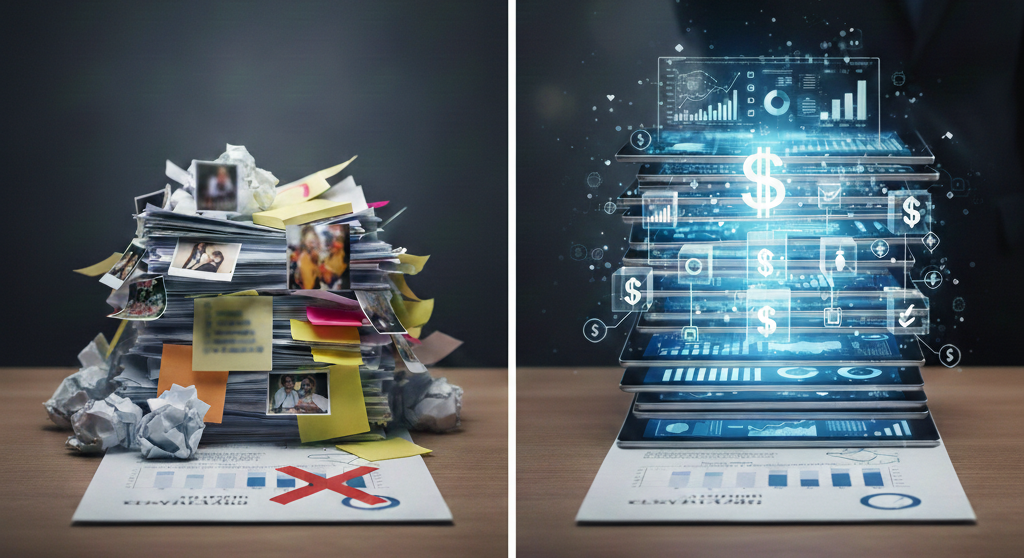

When selling a business, the starting point is always the company’s current position—its performance, profitability, and market standing. Buyers are first and foremost interested in what exists today. Is the business profitable? Is it operationally sound? Is it stable? These are the foundations of any credible valuation.

But beyond that, what makes an opportunity truly compelling is its future. That’s where forecasting becomes a powerful supporting tool. It helps tell the story of growth, strategic direction, and return on investment—elements that make a business more attractive to the right buyer.

Why Forecasts Matter

A forecast helps frame the company’s future in practical terms. It supports the valuation by providing structured insight into what the business could achieve based on today’s reality. It gives potential buyers a sense of direction, anticipated performance, and the resources or initiatives required to unlock growth.

While it’s possible to value and sell a business without a formal forecast, that usually limits the depth of the conversation. Without forward-looking data, discussions tend to revolve solely around past results—when what buyers often want is a sense of what comes next.

Let the Owner Lead the Forecast

No one knows the business better than its owner and leadership team. That’s why the most credible forecasts come from inside, built on first-hand knowledge of the market, customers, cost structure, and capabilities.

A forecast is ultimately a reflection of the owner’s vision, backed by realistic assumptions. Buyers don’t expect certainty, but they do expect thoughtful preparation. Presenting your own forecast shows you’re not just selling a company—you’re presenting an investment opportunity.

Be Realistic, Be Balanced

A common trap in forecasting is leaning too far toward optimism or excessive caution. Overpromising can erode buyer trust, while underplaying potential might leave value on the table. The goal isn’t to impress—it’s to inform.

A balanced forecast, ideally offering both a base case and a growth scenario, is a great way to show ambition while maintaining credibility. It sets a clear framework for discussions about future performance, risk, and upside.

More Than Just Numbers

A good forecast includes more than revenue and profit. Operational and strategic metrics—customer retention, average deal size, recurring revenue, or backlog—help buyers understand how the business performs and scales.

These indicators reflect management quality and the business’s readiness for growth, adding an extra layer of professionalism to the sale process.

A Starting Point for SMEs

Many SMEs haven’t built formal forecasts before—and that’s perfectly understandable. Running a business often leaves little time for forward planning. But starting small can go a long way. A simple forecast, even one built around a few key assumptions and growth levers, helps organize the company’s story and present it more confidently to investors.

At Advisory34, we help SME owners translate their business vision into structured forecasts and financial models that support valuation and enhance buyer confidence. If you’re considering selling your business—or simply want to be ready when the time comes—we’re here to help. Learn more at www.advisory34.com.