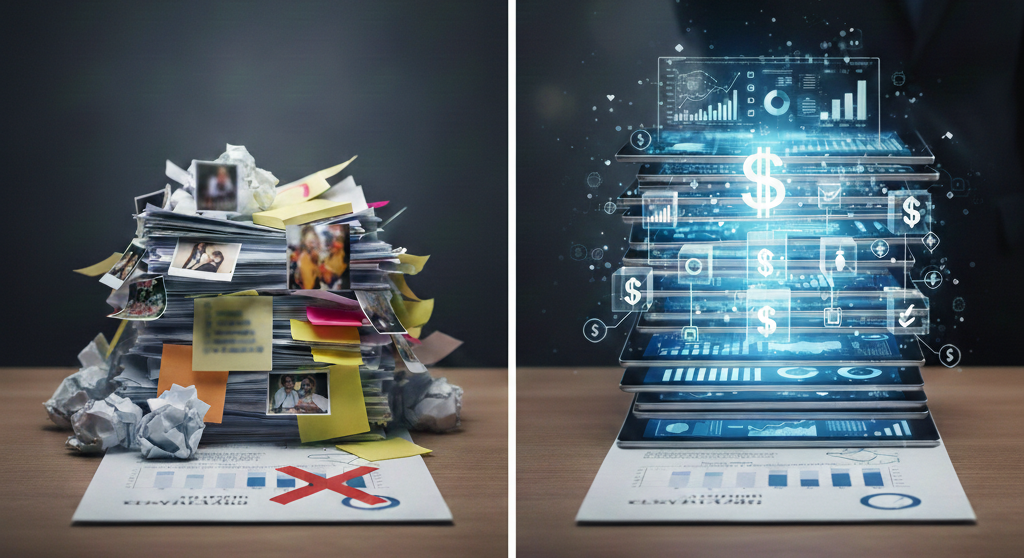

When evaluating a business, most valuation methods tend to focus heavily on financial metrics such as revenue, EBITDA, cash flow, and profit margins. These metrics are undoubtedly important, but they don’t tell the full story. Non-financial factors, which are often intangible, can significantly impact a company’s valuation and its long-term success.

These non-financial factors add depth to business valuation, providing insight into a company’s future potential beyond the current balance sheet. While financial metrics show past performance, non-financial factors reflect the strength of the foundation on which future growth will be built.

In this article, we’ll explore key non-financial factors—such as intellectual property, brand reputation, customer loyalty, and the strength of your team—and explain why they matter just as much as traditional financial data.

1. Intellectual Property

Intellectual property (IP) such as patents, trademarks, copyrights, and trade secrets can dramatically enhance a company’s value. IP acts as a unique competitive advantage, providing legal protection over innovations and preventing competitors from copying them. In industries like technology and pharmaceuticals, IP can be one of the most valuable assets a company possesses. Strong IP can boost valuation by guaranteeing a future stream of income, making your business more attractive to potential buyers or investors.

2. Brand Reputation

A strong brand reputation can create a significant value premium in a business valuation. Brands that have built a loyal customer base and are associated with trust, quality, and reliability often enjoy a competitive edge. Brand value is often measured using a “brand equity” model, reflecting how well consumers recognize and respect a brand. This recognition helps drive demand, enabling businesses to charge premium prices and retain customer loyalty.

3. Customer Loyalty and Relationships

The value of a loyal customer base cannot be overstated. Businesses with high levels of customer retention tend to generate consistent and predictable revenue streams, which lowers risks for potential investors or buyers. Customer loyalty reflects how well a company meets its customers’ needs and builds strong relationships over time.

When evaluating a business, understanding the customer churn rate, recurring revenues, and the strength of client relationships is crucial. A company with long-term contracts or a subscription model that keeps customers engaged can significantly enhance its valuation by ensuring future revenue streams are secure. Additionally, loyal customers can become advocates for the brand, further enhancing growth through word-of-mouth marketing and repeat business.

4. The Strength of Your Team and Company Culture

A business is only as strong as the people behind it. The quality and experience of the management team, as well as the broader company culture, play a significant role in the overall valuation. Investors or buyers often assess whether the management team is capable of executing growth strategies, managing risks, and leading the company through market challenges.

A strong team with a proven track record reduces operational risks and enhances a company’s ability to innovate and expand. Similarly, a positive company culture that fosters employee engagement, creativity, and retention is crucial. High employee turnover can be costly and disruptive, whereas companies with a strong, cohesive workforce tend to perform better in the long term.

5. Operational Efficiency and Scalability

Operational efficiency measures how well a company uses its resources to produce goods and services. A well-run company that maximizes productivity while minimizing waste and inefficiencies often commands a higher valuation. Moreover, scalability is another critical factor. Investors look for businesses that can grow without a proportional increase in operational costs. If a business has the infrastructure, processes, and technology in place to scale efficiently, it becomes a much more attractive target for acquisition or investment.

How Advisory34 Can Help

At Advisory34, we believe that business valuation goes far beyond numbers on a balance sheet. While we will request your financial statements to understand the financial health of your business, our process doesn’t stop there. We will sit down with you to learn about the journey that has shaped your business—the decisions, challenges, and milestones that have brought it to where it is today. We’ll dive deep into how you operate, the unique strengths of your team, and the intangible assets you’ve built, such as customer loyalty and brand reputation. By considering both financial data and these critical non-financial factors, we ensure that your business’s true value is fully recognized and reflected.

Reach out today for a consultation and let us help you recognize the true value of your business.