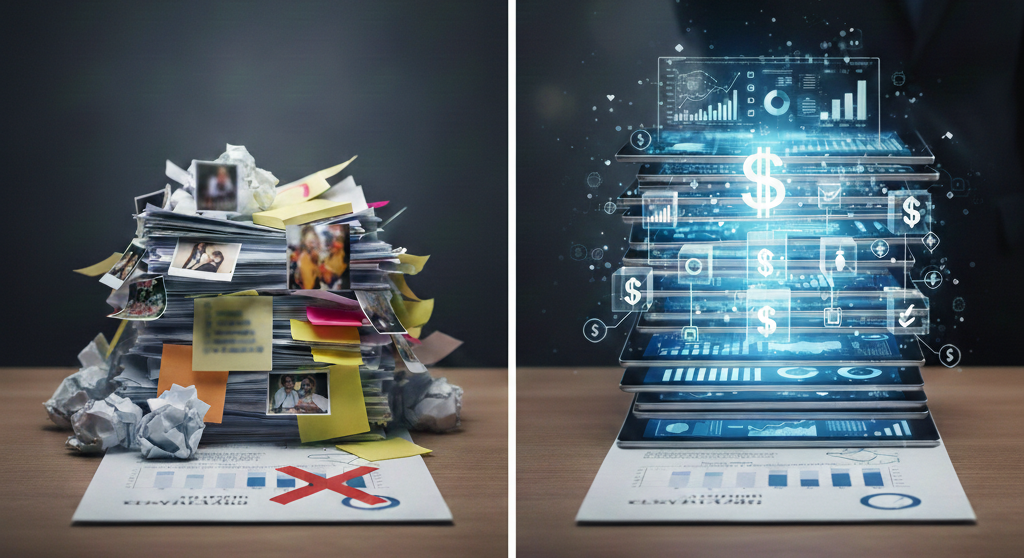

In the world of Mergers & Acquisitions (M&A), timing can be as important as strategy. Economic cycles — whether marked by booming growth or a downturn — significantly shape the landscape for business valuations and M&A activity. Understanding how these cycles influence valuations and deal activity is crucial for business leaders and investors alike, especially when deciding the right moment to buy, sell, or hold.

How Economic Cycles Affect Business Valuations

Business valuations are closely linked to economic conditions. During periods of economic expansion, companies often experience stronger revenue growth, better cash flow, and increased demand for their products or services. These factors can elevate valuations as buyers are willing to pay a premium for companies with robust performance and promising growth. By contrast, in a downturn or recession, lower consumer spending, reduced revenue, and tightening credit conditions can bring valuations down as buyers become more risk averse.

Impact of Market Conditions on M&A Activity

Economic cycles also influence the volume of M&A transactions. In times of economic growth, companies with strong cash reserves and access to favorable financing are more inclined to pursue acquisitions. In contrast, during economic downturns, M&A activity tends to slow as financing becomes less accessible and companies focus on conserving capital. However, there’s a counter-trend: strategic or financially strong acquirers often capitalize on economic downturns to acquire undervalued assets or struggling competitors at discounted prices.

Best Timing for Acquisitions and Exits

When considering M&A, understanding market cycles helps determine the best time to acquire or sell a business. Generally, if valuations are high, it might be an ideal time for a business owner to sell. For buyers, downturns can present favorable acquisition opportunities, with the understanding that long-term gains may outweigh immediate risks.

- Selling During a Boom: A booming economy is generally a seller’s market. If a company’s financials are strong and aligned with the growth trends, this is an opportune time to consider selling to capitalize on high valuations and strong buyer interest.

- Acquiring During a Downturn: For buyers with available capital, downturns can offer attractive deals. Businesses acquired during tough times can yield significant returns when the economy eventually recovers.

Strategic Considerations for M&A in Any Economic Cycle

Regardless of the economic climate, successful M&A requires careful planning and a deep understanding of market conditions. Here are some considerations for both buyers and sellers:

- Risk Assessment and Due Diligence: Economic downturns increase risk, making thorough due diligence essential to identify potential challenges, such as declining cash flow or operational vulnerabilities.

- Alignment with Long-term Goals: Both buyers and sellers need to consider whether a transaction aligns with their strategic vision. For buyers, the focus should be on finding synergies that will drive growth and improve resilience, especially in uncertain economic conditions.

- Financing and Cash Flow Management: In volatile times, having flexible financing and healthy cash flow becomes even more critical. Interest rate fluctuations, for instance, can have a profound impact on deal feasibility.

How Advisory34 Can Help

At Advisory34, we understand the complexities of these economic cycles and are dedicated to helping business owners and investors navigate them effectively. Our team of experts brings years of experience in M&A advisory, providing tailored strategies that align with your long-term goals, whether you are looking to sell, acquire, or invest.

We support our clients every step of the way by offering market insights, rigorous due diligence, and customized deal structuring to ensure the right decisions are made at the right time. To learn more about how we can help you optimize your M&A strategy, visit www.advisoy34.com.