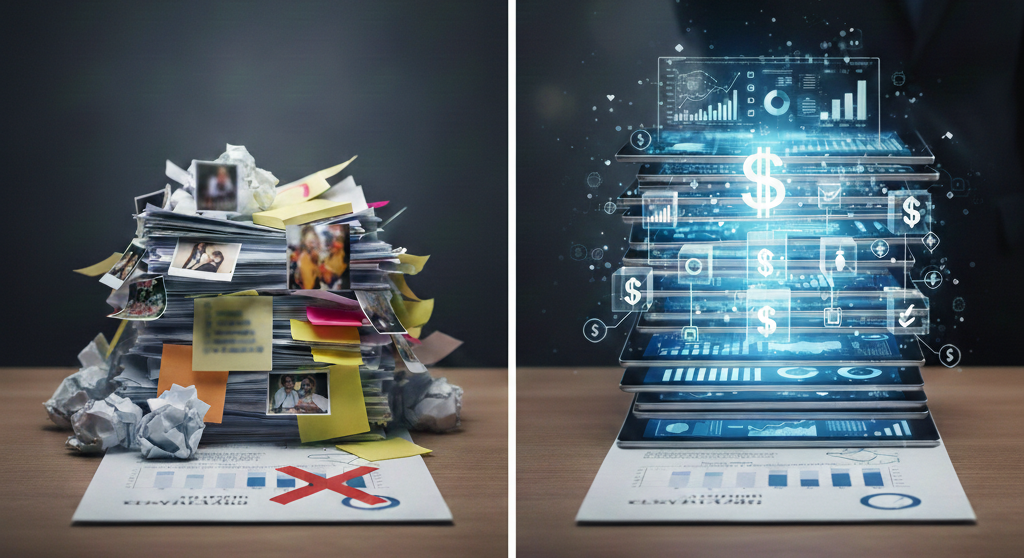

Due diligence is a comprehensive investigation and analysis process undertaken by businesses involved in buying or selling. It is a non-negotiable step for substantial transactions, playing a critical role in assessing and mitigating risks before engaging in significant transactions or partnerships.

While the advantages of due diligence are numerous, the major benefits include:

- Risk Mitigation: Due diligence helps in identifying and mitigating risks associated with a potential transaction, enabling better decision-making and the development of strategies to address challenges.

- Informed Decision-Making: Conducting a thorough investigation equips both buyers and sellers with comprehensive information, facilitating well-informed decisions crucial for the success of any transaction or partnership.

- Value Assessment: Through due diligence, businesses can accurately (or reasonably) assess the value of the target entity, ensuring fair deal terms and a clear understanding of the value proposition for both parties.

- Legal and Regulatory Compliance: Legal due diligence ensures compliance with applicable laws and regulations, helping to avoid legal complications and potential liabilities in the future.

What to Cover During the Due Diligence Process:

Whether it’s a merger, acquisition, investment, or contractual agreement, due diligence assesses the financial, operational, and legal aspects of a business. It may include a strategic component to evaluate market potential, competition, and the overall long-term vision of the company, as well as cultural due diligence in some situations to assess compatibility, especially during mergers and acquisitions.

- a) Financial Due Diligence: This involves a comprehensive examination of financial statements, cash flow, assets, liabilities, and potential financial risks to understand the target company’s financial health and overall performance.

- b) Legal Due Diligence: Thorough examination of legal documents, contracts, licenses, and potential legal issues ensures compliance, identifies pending litigation, and assesses overall legal standing.

- c) Operational Due Diligence: Focused on day-to-day operations, this includes evaluating processes, supply chain, technology, and potential operational risks, essential for identifying improvement areas and challenges.

When and Who Should Perform Due Diligence?

Both buyers and sellers are recommended to conduct their own due diligence. Sellers should proactively prepare and conduct due diligence to enhance value, attract serious buyers, build trust, minimize risks, and ensure a smoother transaction process. Buyers should perform due diligence to gain a comprehensive understanding of the target business before committing to a transaction.

How Can We Assist You?

Advisory34 plays a crucial role in assisting with due diligence during business transactions. We provide guidance on the process, organize due diligence documents, identify potential concerns, connect, when it’s relevant, with legal experts, accountants, or industry specialists, establish confidentiality agreements, and prepare the business for a smooth and realistic valuation.

Ready to explore more about the due diligence process or seeking hands-on support? Reach out anytime – we’re dedicated to guiding you through every stage of your journey. Let’s connect and navigate this together!