Financial valuation refers to the process of determining the monetary value or worth of an asset or a company. In the process of mergers & acquisitions, this step becomes essential as it helps both the buyer and the seller understand what the business is worth in the marketplace.

As a seller, valuing your business significantly enhances your chances of attracting serious buyers. It showcases your dedication to selling your business and makes potential buyers more inclined to meet the price you’re asking for.

But how much is my business worth, and how do I value it?

There are several valuation approaches (Income, Asset, Market,…) and methods such as Discounted Cash Flow (DCF) Analysis, Comparable Company Analysis (CCA) or Relative Valuation, Comparable Transaction Analysis (CTA), Precedent Transactions Analysis, Asset-Based Valuation, Market Capitalization, and more.

When it comes to valuation methods, there’s no one-size-fits-all approach. Different valuation methods may be more appropriate for different situations, and often a combination of methods is used to arrive at a more comprehensive and accurate valuation.

The choice of a method depends primarily on the size of the company, its type, industry, financial stability, and the purpose of the valuation.

If you are acquiring or selling a business, the value depends on the requirements and perspectives of both the seller and the buyer. It is also determined by various factors, including risk assessment, growth potential, cash flow, sustainable profit, asset value, human resources, financial track record, geographic location, online presence, competition landscape, brand awareness, customer base, and industry trends, among others.

How can you increase the value of your business?

It is obvious that the more profitable your business is, the more value it has. However, the determination of your business’s value involves various external and internal factors beyond mere profitability. Check out this article (How can you increase the value of your business), where I have compiled fifty key elements that influence any business’s value.

Overvaluing your business, the major risk!

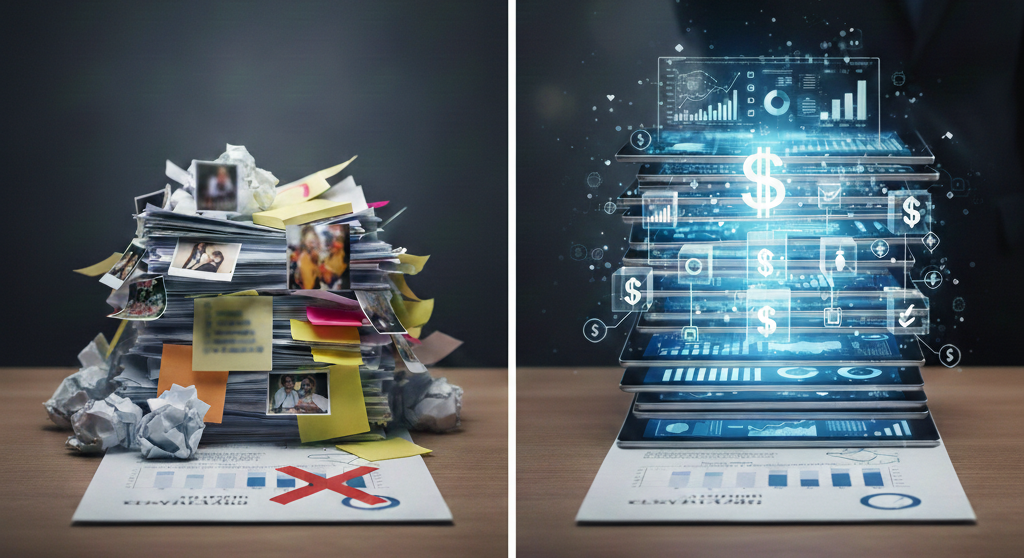

One of the significant risks in the financial valuation process is overvaluation. Business owners tend to monetize the blood, sweat, and tears of a lifetime investment into their company value and subsequently into the asking price.

Emotional biases, akin to a seller’s pride in their business or an attachment to past investments, can lead to an inflated perception of the business’s worth. Overvaluation poses substantial risks, potentially discouraging serious investors, delaying negotiations, and leading to a prolonged sales process.

At Advisory34, we understand the importance of this process and collaborate with financial experts to provide sellers and buyers with a reasonable estimate of the business’s value. Our approach is tailored to the individual needs of each business, ensuring that the valuation reflects not only its current standing but also its future potential.

Reach out to our team, and we will provide the guidance you need to navigate these critical aspects effectively!